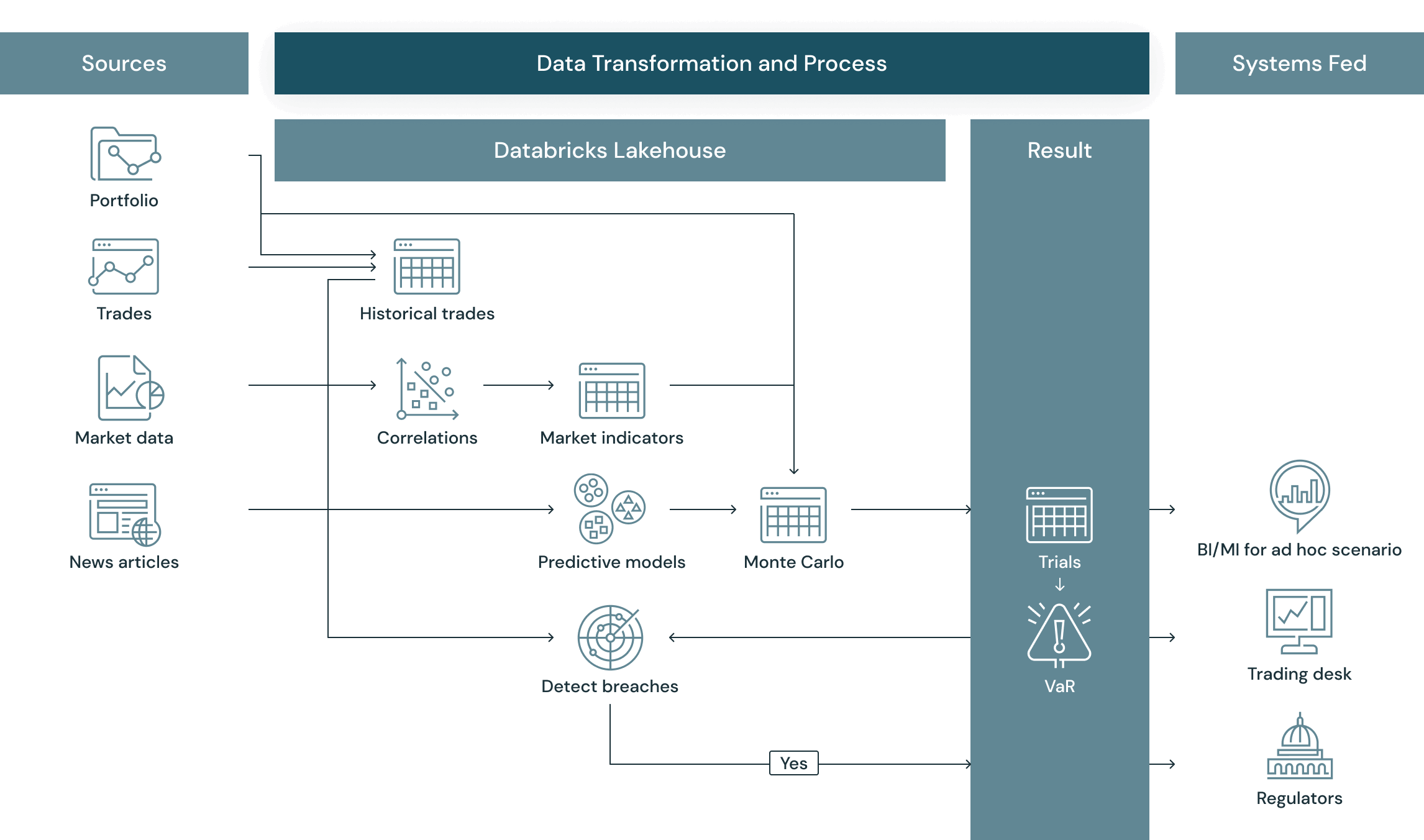

This solution has two parts. First, it shows how Delta Lake and MLflow can be used for value-at-risk calculations — showing how banks can modernize their risk management practices by back-testing, aggregating and scaling simulations by using a unified approach to data analytics with the Lakehouse. Secondly, the solution uses alternative data to move toward a more holistic, agile and forward-looking approach to risk management and investments.

Read the full write-up part 1

Read the full write-up part 2